- WHY DOES THE FEDERAL GOVERNMENT BORROW MONEY? ….

WHEN IT CAN PRINT MONEY? - WHY DOES THE FEDERAL GOVERNMENT RAISE TAXES? ….

WHEN IT CAN PRINT MONEY? - QE EXPLAINED (QUANTITATIVE EASING)

- JAPAN IS WORLD CHAMPION IN GOVERNMENT “DEBT”

- GOVERNMENT “DEBT” TO GDP RATIOS ARE A FALSE FORMULA

- COMMUNIST USSR VERSUS COMMUNIST CHINA — A COMPARISON

- A WARNING FOR THE WEST

- THE HISTORY OF THE USSR

- RUSSIA IS NOT A COMMUNIST NATION — RUSSIA IS NOT THE USSR

- BANKING IN THE USSR DURING THE COMMUNIST ERA – MISTAKES MADE

==================================================================

WHY DOES THE FEDERAL GOVERNMENT BORROW MONEY? ….WHEN IT CAN PRINT MONEY?

WHY DOES THE FEDERAL GOVERNMENT RAISE TAXES? ….WHEN IT CAN PRINT MONEY?

These questions confuse just about everyone who is not involved in the world of high finance. They are all over the internet at present, causing great consternation.

The confusion springs from a misunderstanding of language. Three words are to blame — debt, borrow and print. Most people assume that they understand these words but when it comes to Government finances, that assumption is false.

The word “debt” is where the confusion erupts. The word “borrow” is also inappropriate to use when discussing Federal Government finances. And the word “print” is often used incorrectly in regard to money supply. No wonder there is confusion.

The fact of the matter is that Federal Governments do not borrow money (generally, in most circumstances) and, in advanced economies, they print only 2 % of the money supply (as notes and coins). That sounds ridiculous but it is true.

In order to fund their budget deficits, national governments sell contractual securities issued by their Treasury department (usually called Treasury Bonds). The bonds are contracts for investment, offered to willing investors for a defined period of time at a defined rate of return and which expire at the Maturity Date defined within the contract terms. The funds that governments receive from the investors are used in their expenditure programs. They finance their budget deficits.

Governments are not “in massive debt” that has enslaved them. They have sold securities and received funds. They (almost always) repay the investors at Maturity Date. Defaults by governments on such contractual agreements are rare.

So – BOOM wants to make it crystal clear. Governments are NOT “borrowing large amounts of unpayable debt” and they are NOT “printing massive amounts of new money”. Our children and grandchildren will not be “enslaved by government debt”.

In fact, almost ALL of the money used by Bond investors when they purchase Government Bonds is old money which was created (originated) some time previously in a bank loan contract. In fact, it may have originated in a home loan contract 20 years ago. That old money, received by the Treasury department from the investors, is then re-circulated (spent) into the real economy by governments as part of their expenditure program.

In other words, NO NEW MONEY is created when a Government funds its deficit spending program ………. with one exception. That is when a central bank runs a Quantitative Easing Program (QE) – which, believe it or not, is a relatively rare event.

One more thing is important to mention. Governments (in almost all cases) do not apply to banks for bank loans. Unlike bank loans, Bonds are not collateralised. This is an important point. No collateral is offered to investors as security by the government.

Now, let’s look at the rare exception …. QE EXPLAINED

Quantitative Easing Programs — QE in plain language that anyone can understand ….

Quantitative easing (QE) is a rarely used form of monetary policy in which a central bank purchases securities (such as Govt Bonds or other securities) from the Treasury or on the open market to reduce interest rates and increase the money supply in the real economy. The effect of this is to raise CPI inflation in the real economy (where goods and services are transacted). It also tends to cause Asset Price inflation — but that discussion is for another day.

After the purchase is completed, the central bank holds the bonds. And the funds used for settlement flow to the Treasury. The Government then spends those funds as per usual according to its budgetary requirements. These funds are over and above the funds raised by the government from taxation.

To fund those Bond purchases, the central bank creates new bank reserves inside the banking system which can also be used to provide banks with more liquidity, encouraging lending and investment.

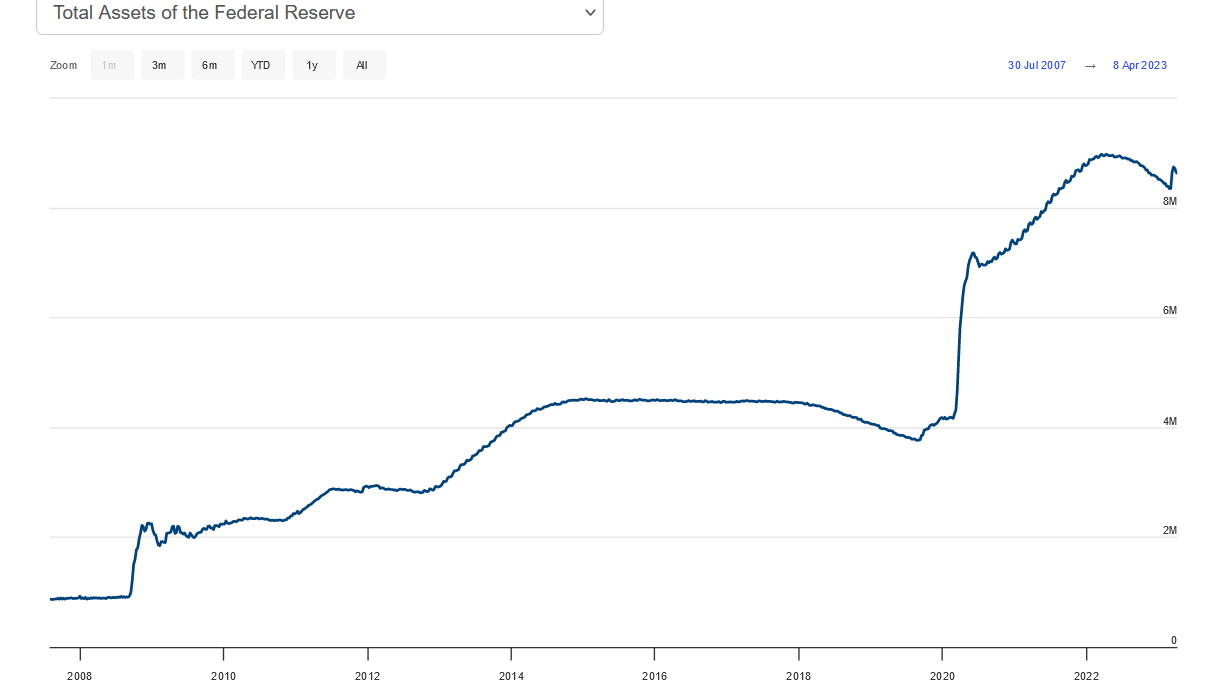

This graph shows the balance sheet of the US central bank (the Federal Reserve) since the Global Financial Crisis in 2008. The QE effects are obvious.

THE FED — TOTAL ASSETS FROM 2008

It shows that US central bank Total Assets have been expanded by about US $ 8 Trillion in QE Programs since 2008. That sounds like a LOT of money. However, it isn’t.

That money was expended by the US government into the real economy to support it (and the banking system) after the Global Financial Crisis in 2008 – 2014 and the Covid Panic-Demic in 2020. Compared to the total cumulative GDP of the US of approximately $ 290 Trillion in that time frame, the total of QE support over the last 26 years has been roughly equivalent to 2.75 %.

The sum is calculated thus — $ 8 Trillion/$290 Trillion X 100 = 2.75 %

That is NOT “massive amounts of fresh new ‘printed’ money”.

Some critics say that the Fed should not have done this. The alternative would have been to collapse the entire banking sector of the United States (which, by the way, had been precariously weakened by rampant fraud in the US commercial and investment banking sector). The choice was stark but, in reality, the central bank decided to bail out the economy and the banking system and the outcome was predictable.

The sad fact of the matter is that not many fraudulent bankers or brokers were sent to jail for those crimes of fraud. But that is another matter altogether. It is another discussion for another day.

JAPAN IS WORLD CHAMPION IN GOVERNMENT “DEBT”

Last week, BOOM pointed out that the Japanese Government is the world champion of Government “debt”. It has a gross debt to GDP ratio of 264 %. This is far, far higher than all other nations. The United States ratio is about 115 %, less than half that. Switzerland’s is about 34 % and Australia’s is about 45 %.

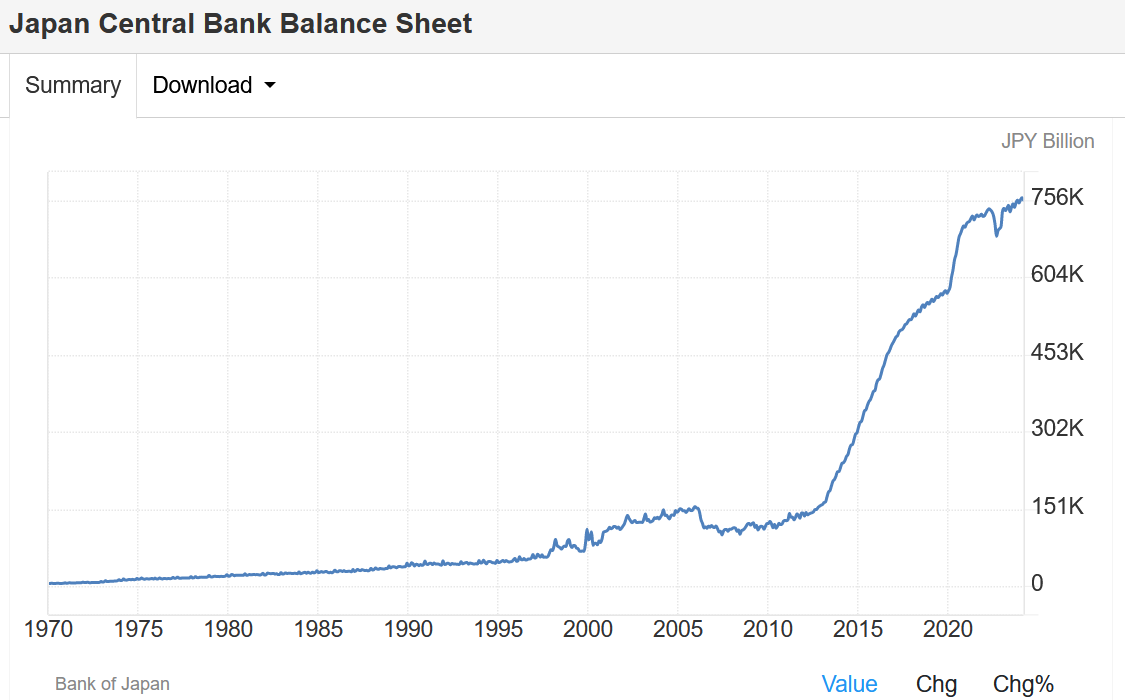

Japan’s huge government Debt to GDP Ratio of 264 % sounds horrendous, doesn’t it? And their central bank’s Balance Sheet also looks dramatically scary?

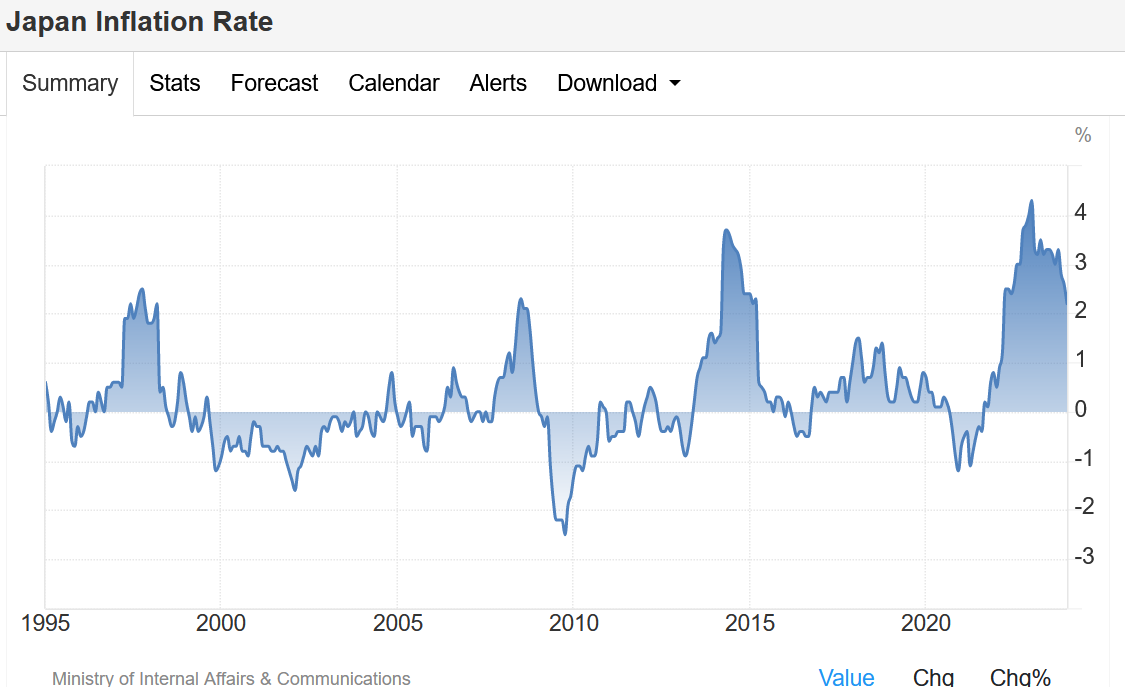

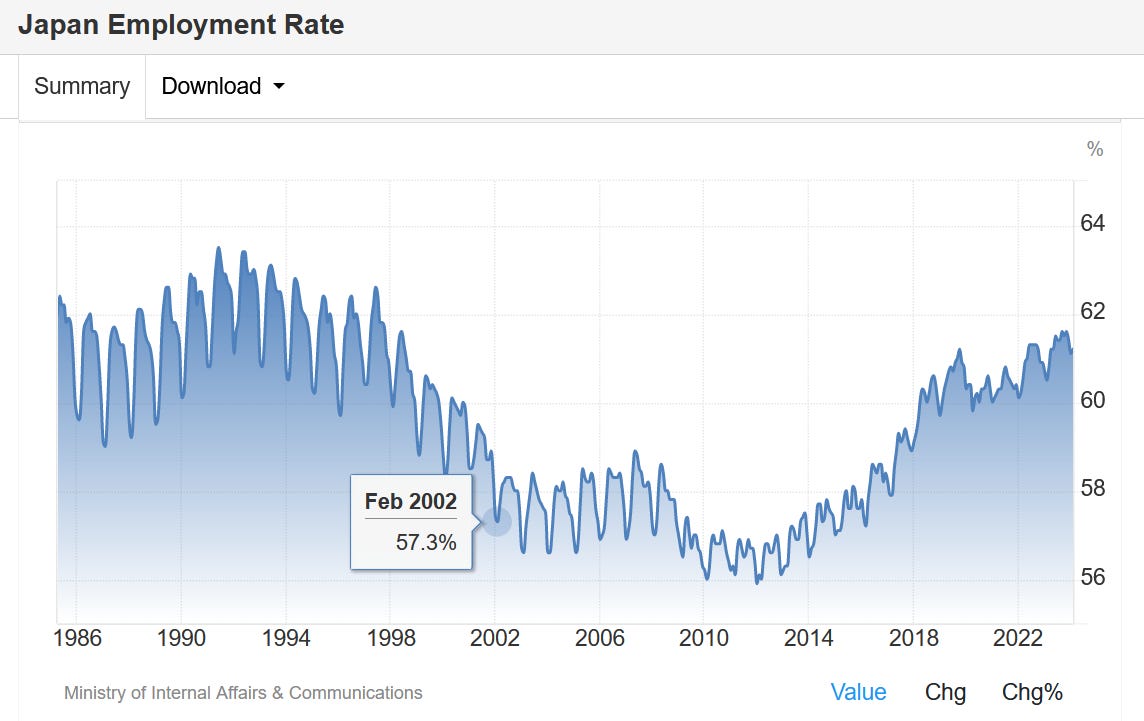

However, the sky has not fallen in Japan and the nation is extremely well fed and well clothed with high levels of employment and low levels of inflation.

What about the currency? (some Doomsters scream).

Here is the US Dollar Versus the Japanese Yen since 2007. The Yen is now falling against the US Dollar over the last 3 years (the USD is rising) but that only means it is simply moving back towards levels seen in the 1980’s. No need for panic.

And, over the last 30 years, Japan has had an average inflation rate of somewhere between 1 – 2 % and a steady employment rate of around 60% of the population (about the same rate as in the United States).

Those economic outcomes are all very acceptable. Are they not?

GOVERNMENT DEBT TO GDP RATIOS ARE A FALSE FORMULA

To keep this discussion in better perspective, BOOM always points out that Government “Debt to GDP Ratios” are a false representation. They compare 20 years of “debt” (Bond issuance) to just one year of GDP. This is disingenuous.

BOOM prefers to express the Ratio as 20 years of government “debt” to 20 years of GDP. That would make a lot more sense, don’t you agree?

As of March 2023, the Japanese public debt is estimated to be approximately 9.2 Trillion US dollars (1.30 quadrillion yen), or 264% of GDP, and is the highest of any developed nation (by far). 43.3% of that “debt” is held by the Bank of Japan (the central bank).

Over the last 20 years, Japan’s GDP has averaged about US$ 5 Trillion per year. Thus, 20 years of GDP is roughly equivalent to $ 100 Trillion in total.

If we divide $ 9.2 Trillion of “debt” by $ 100 Trillion of GDP (instead of $ 5 Trillion), the “Debt” to GDP Ratio falls from 264 % to just 9.2 %.

And, if we subtract the “debt” owned by the central bank, it falls to 5.2 %.

A Debt to GDP ratio of 5.2 % does not sound so bad, does it? And, remember, Japan is the World Champion of government debt. (!) All other governments have “Debt” ratios far, far below that figure.

So — let’s not get too panicky about Government “debt”.

Almost no new money is created in funding it. It is not borrowed from banks in a bank loan. The nation is not offered as collateral. It is not the cause of “horrendous” CPI inflation or terrible unemployment. Our children and grandchildren will not be “forced to pay it off”. And the nation will not “go bankrupt”.

Private debt is another matter — again for discussion on another day.

COMMUNIST USSR VERSUS COMMUNIST CHINA

The long term outcomes between these two communist systems have been very different. Why? BOOM thinks it all boils down to three key factors.

After 70 years of Marxist, communist government, the USSR (the Union of Soviet Socialist Republics) famously collapsed in 1991 both economically and politically.

Communist China has existed since 1949 which is now well over 70 years. However, the People’s Republic of China currently appears to be very strong in both political and economic terms. How can this difference be explained?

The outcomes of the two communist systems are strikingly different because the two systems of communism are strikingly different.

There are reasons for this disparity of outcome.

BOOM explains the differences in outcome as being attributed to three key variables ––

1. the management of the banking/financial system

2. the role of productivity (or lack of it) in the respective real economies (where goods and services are transacted). And …

3. the ownership of private property.

Private property was rapidly and progressively confiscated by the communist State in the USSR. When the USSR was dissolved in 1991, only 0.09% of residences in USSR were privately-owned.

In China, the Constitution was altered in 1982 to allow the private ownership of rights to property. That was strengthened in 1970 with the Property Law.

The USSR leadership was ideology driven. The working class struggle as described by Marx was their inspiration. Unfortunately, Marx did not give a good platform for understanding either money supply management, productivity or property ownership. In fact, the USSR, following Marxist principles, banned the private ownership of almost all property, made many mistakes in money supply and distribution and it did not reward productivity.

These three failings led to the ultimate and predictable collapse of the USSR economy.

A WARNING FOR THE WEST

Ominously, BOOM can see that current Western advanced economies are now all beginning to show signs of failure in all of these three parameters. These nations don’t understand how to generate good, strong management of their financial and banking sectors with effective control of both money supply volume as well as cost. This task has been sub-contracted out to central banks which are potentially in a very compromising, weak position (variously described as being “independent”). They don’t focus on productivity. And private property is progressively falling into the hands of fewer and fewer owners, leaving many citizens to homelessness or destined to rent for their whole lives.

Economic failure is eventually inevitable if thOse three parameters are not carefully attended to. The USSR proved that to us.

MARXIST MISTAKES

Marx had no notion of the key difference between the real economy (where goods and services are transacted) and the financial/monetary/banking side of the economy. Thus, the critical element of disciplined money supply control was largely ignored by the USSR leadership. This led to bouts of CPI inflation that had to be strictly controlled through rigid price control mechanisms and sudden constrictions in the money supply. Distribution of the money supply was also a constant problem without a system of private, commercial banks spread geographically throughout the vast expanses of the USSR empire.

All of that led to instability in economic expectations which eventually resulted in a disastrous lack of productivity in the real economy. This was summed up by the now famous Russian joke phrase “we pretend to work and they pretend to pay us”. Alternatively, “So long as the bosses pretend to pay us, we will pretend to work.”

And, to make matters worse, private property was progressively confiscated.

The Chinese have not made those mistakes. They manage their money supply rigorously and with great discipline as an essential part of the economy. They drive fresh new money created as new bank loans into the economy, where and when needed. This means that the economy does not have to wait for willing borrowers to borrow fresh new credit money into existence. Central command decides when fresh new credit money, created by the commercial banks in bank loans, is directed towards meeting the needs of the real economy. Once that money is allocated, the people in the real economy are focused on using it productively to create useful goods and services. Thus, productivity is assured.

And, last but not least, private ownership of property (residences and businesses) is encouraged.

The Property Law introduced in 2007 protects the interest of private investors to the same extent as that of national interests.

Ownership rights are protected under Article 39 of The Property Law of the People’s Republic of China, which gives the owner the right to possess, utilise, dispose of and obtain profits from the real property. However, this right has to comply with laws and social morality. It can harm neither public interests nor the legitimate rights and interests of others. Foreign investors are not allowed to buy land in China. The land itself in China always belongs to the State and the collectives.

Real property rights in China can generally be grouped into three types: ownership rights, usufructuary rights, and security rights.

Usufruct is a limited real right that unites the two property interests of usus and fructus:

- Usus (use, as in usage of or access to) is the right to use or enjoy a thing possessed, directly and without altering it.

- Fructus (fruit, as in the fruits of production) is the right to derive profit from a thing possessed: for instance, by selling crops, leasing immovables or annexed movables, taxing for entry, and so on

As BOOM often says — money supply is like water for the economic garden. The supply must be matched closely with what is required from the economy. It is the fuel of economic activity.

If a central bank does not monitor and control the money supply strictly and with great discipline, and does not strongly supervise the commercial banking sector, then inevitable bouts of CPI inflation/dis-inflation/deflation and Asset price inflation/dis-inflation/deflation will occur in booms and busts.

If productivity begins to fall progressively over time, then the investments made in productive assets will not generate a suitable return for the risk taken.

And, if people cannot hope to ever own their home or create personal or family wealth, then they will become dis-heartened. This will again result in lower productivity and inevitably a lower demand for bank loans will occur. That lower demand will lower the supply of fresh new money. In other words, the economic garden will begin to die. Ultimately, if these parameters are not corrected, the entire garden will die.

The three key elements for any economy are all intertwined.

THE HISTORY OF THE USSR

The famous Berlin Wall collapsed in November 1989. Unrest had been brewing for a long time, especially in Poland and Hungary. But the fall of The Wall was the event that triggered the beginning of the end for the Communist USSR – the Union of Soviet Socialist Republics.

Mikhail Sergeyevich Gorbachevwas the last leader of the Soviet Union from 1985 to the country’s dissolution in 1991. He served as General Secretary of the Communist Party of the Soviet Union from 1985 and additionally as head of state beginning in 1988, as Chairman of the Presidium of the Supreme Soviet from 1988 to 1989, Chairman of the Supreme Soviet from 1989 to 1990 and the only President of the Soviet Union from 1990 to 1991.

After The Wall collapsed, the US President at the time, George H.W. Bush, met with Gorbachev at Malta in early December 1989. They laid the groundwork for finalising the START negotiations (Strategic Arms Reduction Talks) and completed the Treaty on Conventional Armed Forces in Europe (CFE). Malta was an historic turning point. They also discussed the rapid changes that were occurring in Eastern Europe. Bush encouraged Gorbachev’s reform efforts, hoping that the Soviet leader would succeed in shifting the USSR toward a democratic system and a market oriented economy. Gorbachev’s decision to allow elections with a multi-party system and create a presidency for the Soviet Union began a slow process of democratisation that eventually destabilised Communist control and contributed to the collapse of the communist Soviet Union.

Bush and Gorbachev signed the START treaty at the Moscow Summit in July 1991. Following a great deal of internal disruption, including a failed coup launched by hard-line communists, Gorbachev resigned as President of the Soviet Union on Christmas Day 1991.

On that day, December 25th, 1991, the Soviet Hammer and Sickle flag was lowered for the last time over the Kremlin, thereafter replaced by the Tricolour flag of the Russian Federation. Boris Yeltsin became President of the newly independent Russian state. People all over the world watched in amazement as the former Communist monolithic empire of the USSR was transformed into multiple separate, independent, democratic nations. This relatively peaceful transition averted global warfare and allowed the people in those nations to find their own destiny.

RUSSIA IS NOT A COMMUNIST NATION

And please remember, Russia is not the USSR. It is not a communist nation. It has an effective, independent central bank owned by the government and an effective system of privately owned commercial banks. It is also a nation focussed on productivity. It has enormous resources. And it has a system of private property.

Russia and China have now developed a strong bond of mutual cooperation.

MORE MISTAKES — BANKING IN THE USSR DURING THE COMMUNIST ERA

Following the Russian Revolution in 1917, all of the banks’ assets were nationalised and liabilities cancelled (in late 1917). Banking was declared a State monopoly.

From January 1920 to October 1921, there were no banks at all in operation in Russia. After that period of great turmoil, a banking system gradually took shape where there was distinction made between bank money and money in the real economy. But control of the money system was always strictly centralised and private bank ownership remained banned.

The Soviet banking system relied on several specialized financial institutions, which were reorganized in waves of reform following major leadership transitions in 1928-1932, 1955-1959, and 1987-1988:

- the State Bank of the USSR (Gosbank), was established in October 1921 as the State Bank of the Russian Soviet Socialist Republic. Its scope was expanded to the whole of the Soviet Union in 1923.

- the State Labor Savings Banks System (Gostrudsberkassy), evolved from the savings banks of the previous Russian Imperial Empire and became a monopoly retail banking system. In 1963, the savings banks system was transferred under the jurisdiction of the Gosbank. It was reorganised in 1987 as the Savings Bank of the USSR.

- the Industrial Bank (Prombank) was established in 1922. In 1959 it became the All-Union Bank for Financing Capital Investments (Stroybank). In 1988, it was reorganised as the State Commercial Industrial and Construction Bank of the USSR (Promstroybank), with some operations spun off as Agro-Industrial Bank (Agroprombank) and the Bank of Housing, Communal Services and Social Development (Zhilsotsbank).

- the cooperative banking system, established in 1922 as the Bank of Consumer Cooperatives (Pokobank), was reorganized in 1923 as the All-Russian Cooperative Bank (Vsekobank), then replaced in 1936 with the All-Union Bank for Financing the Capital Construction of Trade and Cooperation (Torgbank) and eventually abolished in 1956. A decisive, historic moment — that was the end of consumer cooperative banking in the USSR.

- the Central Bank of Public Utilities and Housing Construction (Tsekombank) was established in 1925 and terminated in 1959 with its operations allocated to the Gosbank and Stroybank. Another decisive moment — the end of a separate financial management for housing construction, presumably deemed unnecessary as there was no ownership of private property.

- the Agricultural Bank of the USSR (Selkhozbank), established in 1932, terminated in 1959 with its operations allocated to the Gosbank and Stroybank. Yet another decisive moment — the end of geographically distributed banking services for the agricultural sector.

- the Foreign Trade Bank of the USSR was established in 1922 as Roskombank. In 1988 it was reorganized as the Bank for Foreign Economic Affairs of the USSR (Vnesheconombank).

That history reveals the mistakes made in the USSR’s banking sector and its impact in the industrial sector, housing sector and agricultural sector. Those mistakes in rigidly centralising financial management and control led, inevitably, to falling Productivity in the real economy. Without privately owned, geographically distributed commercial banks, without sustained productivity improvements and without privately owned housing, the economy was doomed.

CHINA HAS NOT MADE THOSE MISTAKES

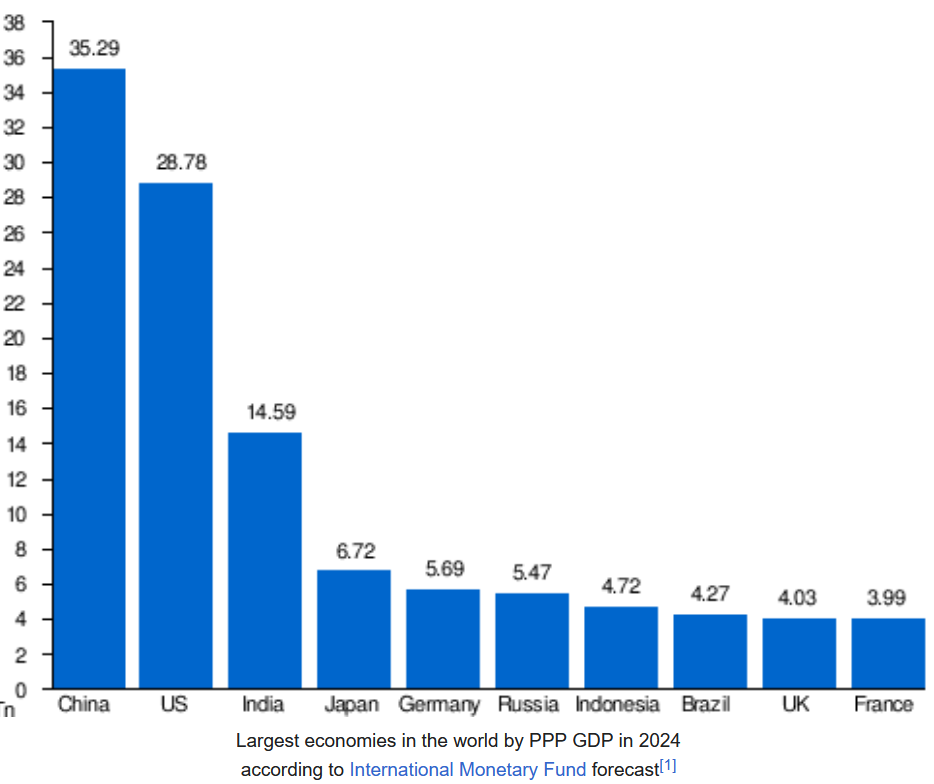

China has learnt from those mistakes and has adopted a very different structure of “communism”. Their economy is already the largest economy on Earth on a PPP basis. GDP (PPP) means gross domestic product based on purchasing power parity.

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

BOOM — ALL PREVIOUS SUBSTACK EDITORIALS AVAILABLE AT BOOM SUBSTACK ARCHIVE.

ALL PREVIOUS EDITORIALS AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years on other platforms which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Thanks for reading BOOM Finance and Economics Substack! Subscribe for free to receive new posts and support my work.