CHINA RESCUES SOUTH AFRICA

China has agreed to help South Africa to improve its ageing coal-fired electricity generation units and expand its transmission lines. A joint Memorandum of Co-operation was signed on the side lines of the 15th BRICS Summit in Johannesburg last week.

This is a very significant development which should allow South Africa to realise its full potential as an industrialised nation. In fact, South Africa has all the necessary requirements to become a very successful and wealthy nation. Why? Because it has a growing Working Age population, no shortage of labour, abundant resources (including food, water and minerals) and abundant energy – including one nuclear power plant at Koeberg near Capetown. In addition to all of those attributes, it is well connected to the growing BRICS group of nations.

China will also assist in expanding power generation. South Africa has only expanded its transmission network by 4,400 kilometres in the past 10 years and 14,000 km of new lines will be needed over the next decade.

The eight Chinese companies that signed the Memorandum are the State Grid Corporation of China, China-Africa Development Fund, China Energy International Group, China General Nuclear Power Corporation, China National Electric Engineering Company, Huawei Technologies, TBEA Ltd, and the Global Energy Interconnection Development and Co-operation Organisation.

China also donated emergency power equipment and made available a grant of approximately 500 Million Rand as development assistance to South Africa.

BOOM thinks that South Africa has enormous economic potential. It has 60 million people and an economy which is the most industrialised and technologically advanced in Africa. It is the second largest economy in Africa, after Nigeria and the 39th largest in the world. It also has a relatively high gross domestic product (GDP) per capita compared to other countries in sub-Saharan Africa. It could become the new Russia. However it needs political stability, incentives for hard work and risk taking, inter-racial harmony, careful planning and a strong financial sector. All are essential for a nation to thrive.

South Africa’s stock market index, the JSE All Share Index, has risen since the year 2000 from around 5,000 to 75,000. Its current annual CPI inflation rate is at 4.7 % and has fallen from 7.6 % twelve months ago. GDP growth is stagnant at present but that should improve with a reliable power source. Sadly, the unemployment rate is at 32.6 % and youth unemployment is at 60.7 % but this represents a huge potential labour force which could be put to work with good management of the economy.

South African Stock Index —

Before rushing in to buy South African stocks, it is important to understand that their currency, the Rand, has more than halved in price against the US Dollar and the Euro in that time frame. Currency risk is always a consideration when investing in other nations.

THE FEAR CAMPAIGN CRANKS UP AGAIN — FEAR HAS ECONOMIC CONSEQUENCES

The latest viral “threats” which the mainstream media is now promoting are the new “Eris” variant of Covid and the new “Kraken” variant. The Clade numbers for these two new variants are — for Eris, EG 5.1, and for Kraken XBB 1.5

They are cranking up the fear campaign again, urging masks, vaccine mandates and lock downs. And over 60 universities in the US have still not removed their Covid vaccine mandates. The Pandemic of Fear must not be allowed to die.

According to No College Mandates, a website that tracks COVID-related mandates on college campuses, over 60 US universities still require a COVID-19 vaccine to attend, including Harvard University, Rutgers University, and Johns Hopkins University. To quote from Harvard’s website —

“Harvard requires all students who will be on campus to have primary vaccination for COVID-19,” “As we work to continue the high levels of vaccination needed to protect our community, Harvard highly recommends being up-to-date per the CDC definition for all Harvard community members.”

One college is enforcing draconian COVID restrictions because of the Eris “threat”. This week, Atlanta-based Morris Brown College announced a battery of COVID-19 mitigation policies for the next two weeks, “due to reports of positive cases.” These mandates include a broad mask mandate, physical distancing, a ban on on-campus parties and large gatherings, and “temperature checks” when students arrive on campus. Atlanta – the new capital of Fear?

Joe Biden joined in by saying that he would fund a new “more effective” vaccine “that works” against the latest variant that “everyone will be asked to take”. If the aim is create a vaccine “that works”, then presumably the last batch of so called vaccines did not work? (as is now common knowledge).

However, BOOM readers rely on information and not on fear porn. What are the facts?

The Covid Viral Mutation Maps that are readily available at Nextstrain.org reveal the following as at 30th August–

Using Data from GenBank —

The EG 5.1 Eris variant is currently 26 % of global registrations

The XBB 1.5 Kraken variant is currently 19 % of mutation registrations

The XBB 1.16 variant (apparently called Arcturus) is now responsible for 25 %

The XBB 1.9 variant is now at 15 %

The XBB 2.3 variant is now at 10%

The GenBank sequence database is an open access, annotated collection of all publicly available nucleotide sequences and their protein translations. It is produced and maintained by the National Center for Biotechnology Information (NCBI; a part of the National Institutes of Health in the United States) as part of the International Nucleotide Sequence Database Collaboration (INSDC). Funding appears to be provided by the National Institutes of Health, the National Science Foundation, the Department of Energy, and the US Department of Defense.

Using Data from GISAID, the current pattern of global mutation registrations is –

The EG 5.1 Eris variant is currently 29 % of global registrations

The XBB 1.5 Kraken variant is currently 20 % of mutation registrations

The XBB 1.16 variant (apparently called Arcturus) is now responsible for 22 %

The XBB 1.9 variant is now at 14 %

The XBB 2.3 variant is now at 13%

GISAID is the Global Initiative on Sharing All Influenza Data, previously the Global Initiative on Sharing Avian Influenza Data, is a global science initiative established in 2008 to provide access to genomics data of influenza viruses. The database was expanded to include the coronavirus responsible for the COVID-19 pandemic, as well as other pathogens. GISAID funders include the European Commission (sigh) and the Rockefeller Foundation (double sigh). It is based in Munich, Germany.

These relativities of mutation registration have not changed significantly over the last 3 months with the exception that the Eris variant which first appeared in mid May has increased at a faster rate than the other current variants. This is what the Fear Campaign is all about. However, that rate of increase simply shows that Eris is becoming the dominant form of the SARS CoV2 virus.

Please bear in mind that new virus mutation registrations do NOT indicate that anyone is significantly sick from these variants or sick at all. Dominance of one form is also not indicative of any increased health threat. In fact, let’s state it more forcefully, NOBODY may have any significant symptoms or be seriously ill from Eris itself. As with all respiratory viral illnesses, those at any theoretical risk will be the elderly, at the limit of their life expectancies especially those with multiple co-morbid conditions.

Thus, the Covid “Case-demic” appears to be re-occurring – an epidemic of fear driven by mass media sensationalism, not an epidemic of excess death or severe illness from a virus. If this is allowed to run off the rails again, it could have very significant effects on national economies and even the global economy.

The economic damage inflicted over the last 3 years of Covid Panic was severe. Cool heads must prevail if we are to avoid such degree of damage over and over again due to repeated, orchestrated fear campaigns.

ANOTHER SCARE CAMPAIGN LAUNCHED

A White House spokesman has now warned about another “new variant”, reportedly the “ominous” sub-variant BA.2.86 which – surprise, surprise — has not even been publicly acknowledged yet by Nextstrain as far as BOOM can see. And this ominous threat has also been delivered subsequently to the general public by the Washington Post – with apparently just three “cases” (yes three) found in the United States which has a population in excess of 300 million people.

“While only about a dozen cases of the new BA.2.86 variant have been reported worldwide — including three in the United States — experts say this variant requires intense monitoring and vigilance that many of its predecessors did not. That’s because it has even greater potential to escape the antibodies that protect people from getting sick, even if you’ve recently been infected or vaccinated.”

Who are these “experts”? And where is their evidence of any significant illness? How can three (yes, three) mutation registrations indicate a “threat” and generate an article from the Washington Post plus a statement from the White House?

By the way, someone (somewhere) has (apparently) called the BA.2.86 variant the “Pirola” variant. Again, who, where, why? Huh? Is anybody sick yet? Excuse BOOM’s sarcasm.

If you are at all interested, you can read what a real expert Immunologist has to say about it here.

Reference:

The ‘Pirola’ Variant of SARS-CoV-2

3 days ago · 654 likes · 151 comments · Dr. Byram W. Bridle

THIS WEEK’S CHART – DANISH INVESTORS AND CLIMATE CHANGE

This week, we look at the share price chart over 5 years for the Danish company Orsted A/S on the OTC market in the USA. The US Stock Code for the company is DOGEF (alternatively DNNGY). Over the last 3 years, it has moved from around US$ 215 to below $ 65. That is about a 70 % loss from the High. Note the recent plunge in price last week as it suffers a steep collapse.

So – what is this company? What does it do? Some analysts refer to it as the Danish Green Giant.

This explanation is straight from the company itself.

The Orsted vision is a world that runs entirely on green energy. Orsted develops, constructs, and operates offshore and onshore wind farms, solar farms, energy storage facilities, renewable hydrogen and green fuels facilities, and bioenergy plants. Orsted is recognised on the CDP Climate Change A List as a global leader on climate action and was the first energy company in the world to have its science-based net-zero emissions target validated by the Science Based Targets initiative (SBTi). Headquartered in Denmark, Orsted employs approx. 8,000 people. Orsted’s shares are listed on Nasdaq Copenhagen (Orsted). In 2022, the group’s revenue was DKK 132.3 billion (EUR 17.8 billion).

However, despite such high hopes, investors seem disinterested in the company. They have been running for the exits for two and a half years. That seems strange if the future is to be provided by alternative energy sources. As BOOM always says. Make your own conclusions. Do your own research.

EUROZONE M3 MONEY SUPPLY STAGNANT

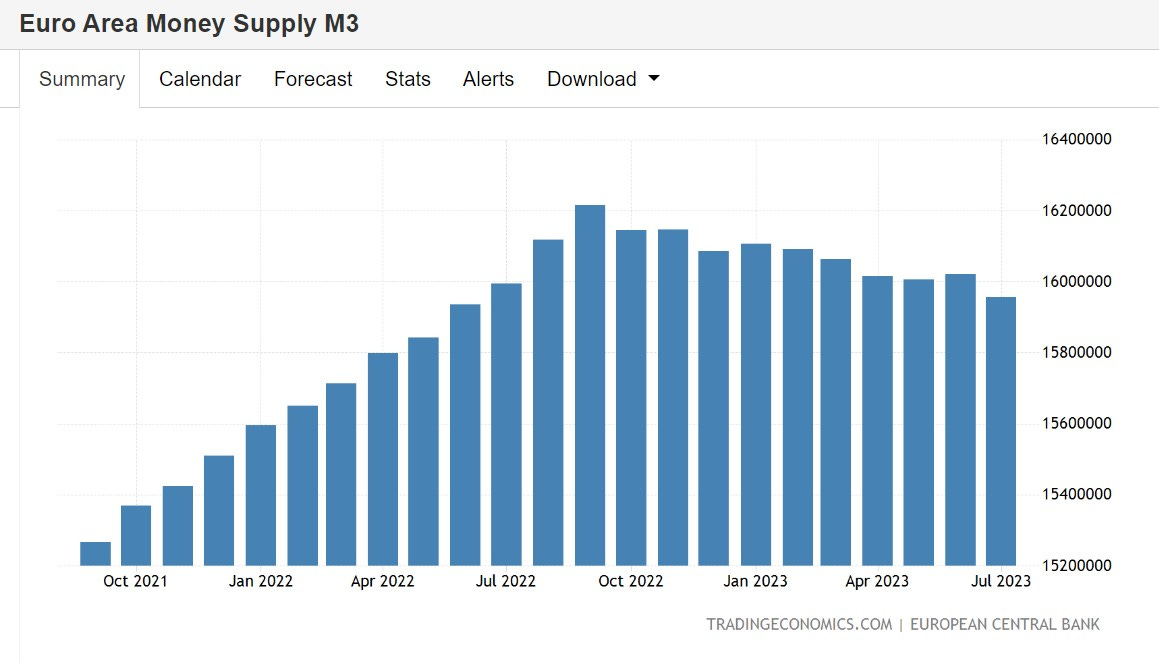

M3 money supply in the Euro area turned negative by -0.4 % YoY (year-on-year) to a total of15.6 Trillion Euros in July. The previous data point for June showed a rise of + 0.6 %. July showed the first month of decline in M3 money supply since May 2010. The narrower aggregate of money supply M1, comprising currency in circulation and overnight deposits also showed a decrease -9.2 %.

M3 money supply in the Euro area has been steadily falling for 12 months now. The rate of decline is not steep but it is relentless. The negative result in June suggests that dis-inflation (falling levels of positive CPI inflation) is accelerating and may well turn into deflation in the months to come for 2023. Along with stagnant economic growth, the outlook is grim. A recession for Western Europe may well be baked into the cake already and should be evident by the end of the year.

RUSSIA HIKES INTEREST RATES – RUBLE STABILISES AGAINST US DOLLAR

The Russian central bank raised its key interest rate two weeks ago, on August 15th. It raised the rate by 350 basis points to 12 %. And the bank made a statement which stated —

“Inflationary pressure is building up”

“The pass-through of the rouble’s depreciation to prices is gaining momentum and inflation expectations are on the rise.”

“In the case of strengthening pro-inflationary risks, an additional increase in the key rate is possible.”

This seems to have slowed the declining value of the Ruble against the US Dollar which began in June 2022. Last June, the exchange rate was hovering around 60 Rubles to the US Dollar. Since then it has declined in value to just above 100 Rubles. And since the interest rate rise, it has appreciated back to around 95.

Does this mean that the Russian central bank has drawn a line in the sand at 100? Possibly.

Any covert, foreign attempt to artificially force down the Russian Ruble’s value against the US Dollar on foreign exchange markets will backfire badly. Its effect on domestic CPI inflation inside Russia will be limited because Russia is self sufficient in many essential goods (especially energy and food) and because its major trading partners are no longer insisting on US Dollar settlement of trades. It will also ensure higher Ruble profits to Russian exporting companies in trades that are settled using US Dollars. And it will enhance Russia’s determination to move away from using US Dollars even more quickly than it is currently.

Thus, BOOM is of the view that the Ruble will stabilise around 100 to the US Dollar. Time will tell.

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

BOOM — ALL PREVIOUS EDITORIALS AVAILABLE AT —

https://boomfinanceandeconomics.wordpress.com/

QUANTITATIVE BOOSTING EXPLAINED

QB Explained: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/

And BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

HOW MOST MONEY IS CREATED

BANKS CREATE FRESH NEW MONEY OUT OF THIN AIR

(but they always need a Borrower to do so)

THERE IS NO SUCH THING AS A DEPOSIT

BANKS PURCHASE SECURITIES, THEY DON’T MAKE LOANS

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY

Watch this short 15 minutes video and learn as Professor Richard Werner brilliantly explains how the banking system and financial sector really work.

How is Most New Money Created ?

LOANS CREATE DEPOSITS — that is how almost all new money is created in the economy (by commercial banks making loans).

From the Bank of England Quarterly Bulletin Q1 2014 —

“Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.““Most money in the modern economy is in the form of bank deposits, which are created by commercial banks themselves”.

YouTube Video — https://www.bankofengland.co.u/quarterly-bulletin/2014/q1/money-in-the-modern-economy-an-introduction

and https://www.youtube.com/watch?v=ziTE32hiWdk

Paper: Money in the Modern Economy — CLICK HERE

Most economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

On 25th April 2017, the central bank of Germany, the Bundesbank, released a statement on this matter —

“In terms of volume, the majority of the money supply is made up of book money, which is created through transactions between banks and domestic customers. Sight deposits are an example of book money: sight deposits are created when a bank settles transactions with a customer, ie it grants a credit, say, or purchases an asset and credits the corresponding amount to the customer’s bank account in return. This means that banks can create book money just by making an accounting entry: according to the Bundesbank’s economists, “this refutes a popular misconception that banks act simply as intermediaries at the time of lending – i.e. that banks can only grant credit using funds placed with them previously as deposits by other customers”. By the same token, excess central bank reserves are not a necessary precondition for a bank to grant credit (and thus create money).”

Reference: https://www.bundesbank.de/en/tasks/topics/how-money-is-created-667392

The Reserve Bank of Australia (Australia’s central bank) has also contributed to the issue in a speech by Christopher Kent, the Assistant Governor on September 19th 2018.“…… the vast bulk of broad money consists of bank deposits”“Money can be created …….. when financial intermediaries make loans““In the first instance, the process of money creation requires a willing borrower.”“It’s also worth emphasizing that the process of money creation is not the result of the actions of any single bank – rather, the banking system as a whole acts to create money.”

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice.The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.