- ARGENTINA – THE FUTURE FOR THE WEST?

- JAPAN’S MASSIVE RAIL SYSTEM AND POWER USAGE

- JAPAN ENERGY CONSUMPTION

- RIDING JAPAN’S FASTEST BULLET TRAIN

- COMPARING ECONOMIES

- CHINA RAILWAYS

- CHINA NEW RAIL INFRASTRUCTURE MASSIVE COMPARED TO THE USA

- LIVING IN CHINA

- WESTERN DEMOCRACY MUST RESCUE ITSELF

- BOOM’s CHINA ECONOMIC INDICATOR RISING STRONGLY

- HOW CAN CHINA ACHIEVE SO MUCH SO FAST?

YOKOHAMA BAY — 19TH CENTURY

Share BOOM Finance and Economics Substack

ARGENTINA – THE FUTURE FOR THE WEST?

BOOM is concerned that Utopian ideologies and poor, incompetent leadership will slowly but surely turn the advanced nations of the Western world into Argentina-like economic basket cases. Sadly, the current social and economic evidence seems to support that thesis.

Argentina fell in love with the Utopian dreams of its inadequate and incompetent leaders about 100 years ago. Since then, the nation has suffered horrendous economic volatility and instability with many dramatic recessions. The people have not benefitted.

The advanced economy nations of the West must, somehow, now try to avoid that destiny. Thoughtful, wise, knowledgeable leadership that is grounded in realities rather than in Utopian dreams is the key ingredient. However it is currently lacking.

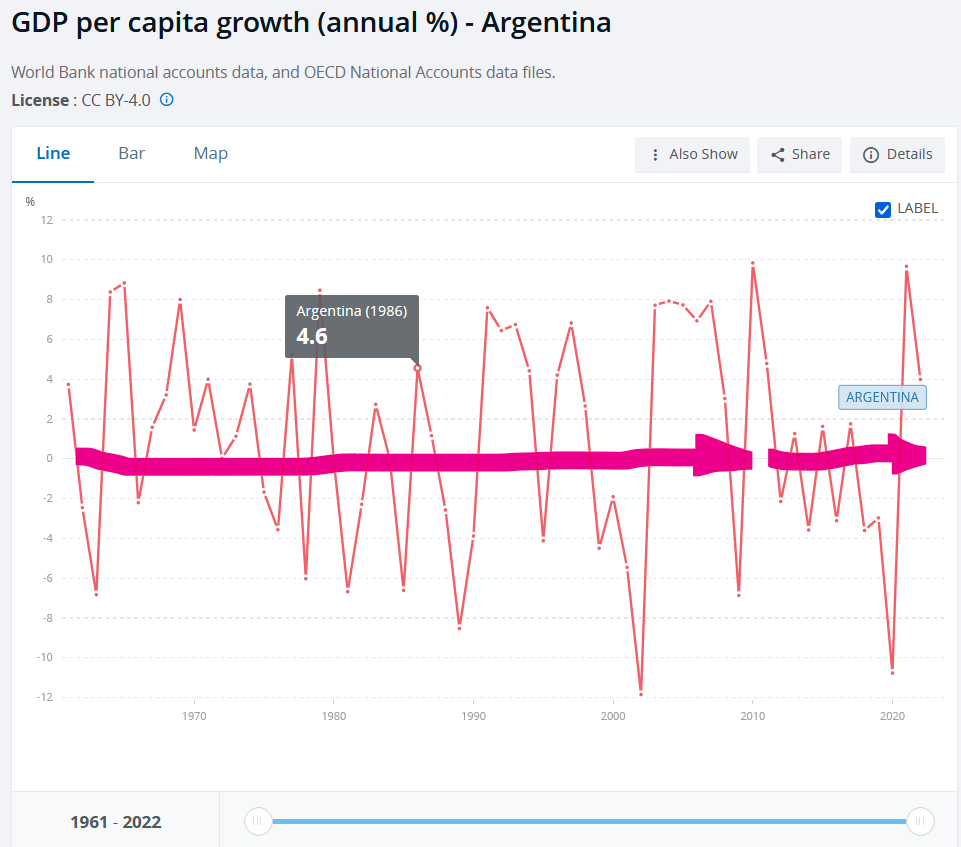

This graph from the World Bank of GDP Per Capita per Annum for Argentina shows the dramatic volatility over time from 1961 to 2022. BOOM, BUST, BOOM, BUST, BOOM, BUST.

24 years of Economic contraction (recession) have occurred in that time frame of 60 years. It is akin to being strapped to the deck of a sailing ship forever and destined to encounter hurricane after hurricane after hurricane.

Meanwhile, the rollercoaster economy has averaged Zero economic growth per annum per capita as shown in the graph. By the way, BOOM does not expect this pattern to change under the new President, Javier Millei.

GDP Per Capita Growth (Annual %) – Argentina

GDP GROWTH PER CAPITA USA, EUROPE, UK

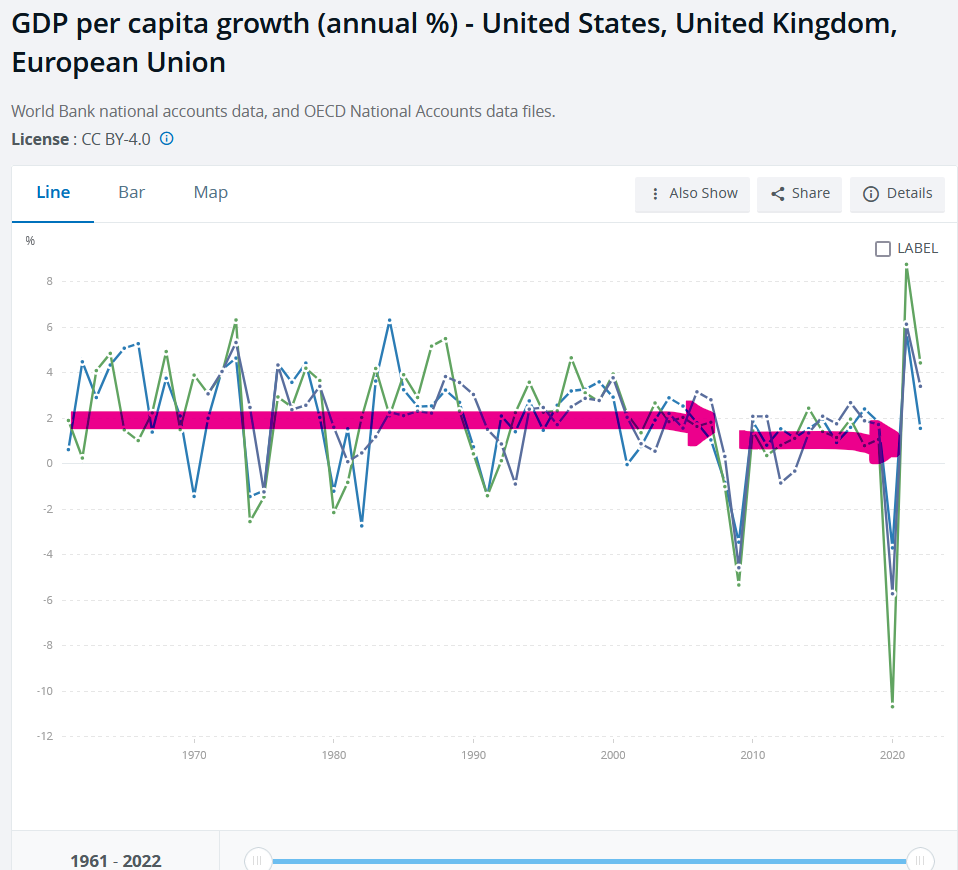

In that same time frame, 1961 – 2022, the US, Western Europe and the UK have displayed much less volatility in economic growth per capita. They averaged about 2 % per annum growth until the Global Financial Crisis of 2008 with only 8 recessions. However, since 2008, economic growth per capita has fallen to an average of about 1 % per annum and they have suffered the foolish, politically led, dramatic Covid Panic Recession of 2020.

BOOM can only identify two leaders amongst all of those nations who could be described as admirable. Both are from Eastern Europe.

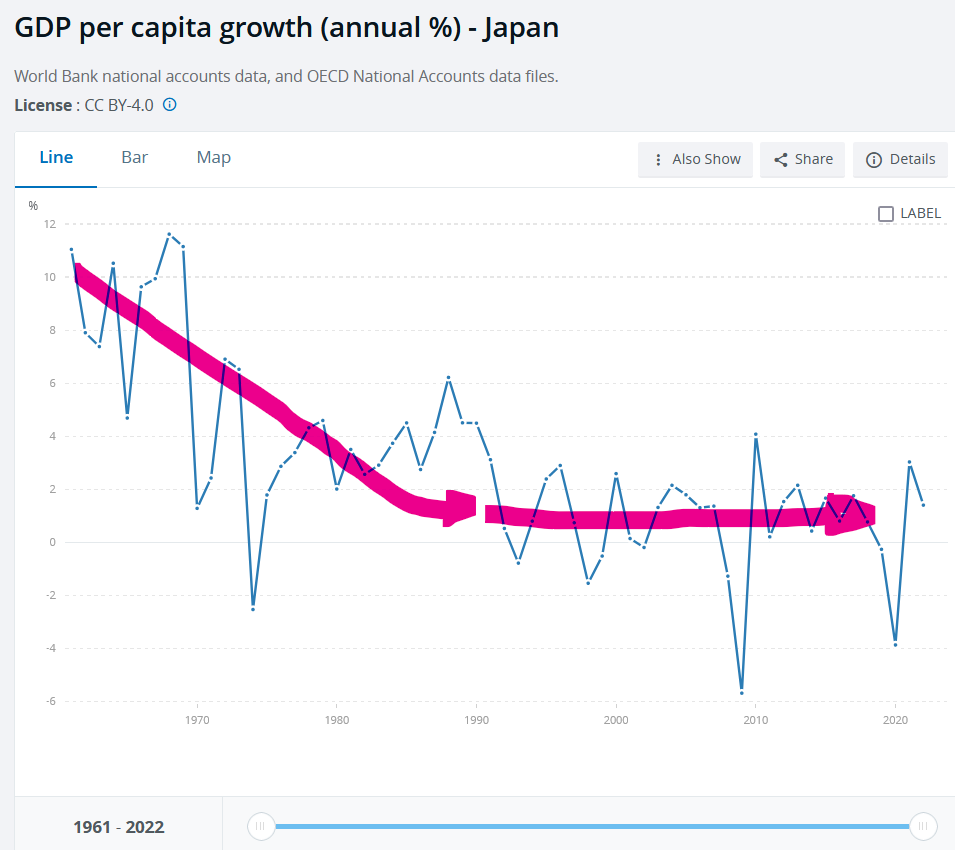

GDP GROWTH PER CAPITA JAPAN

Japan was dubbed the ”miracle economy” in the 1960’s and 1970’s with only one recession in 1974. However, since 1990, its GDP Growth per Capita has fallen to an average of around 1 % per annum. It has had 6 recessions in that time period.

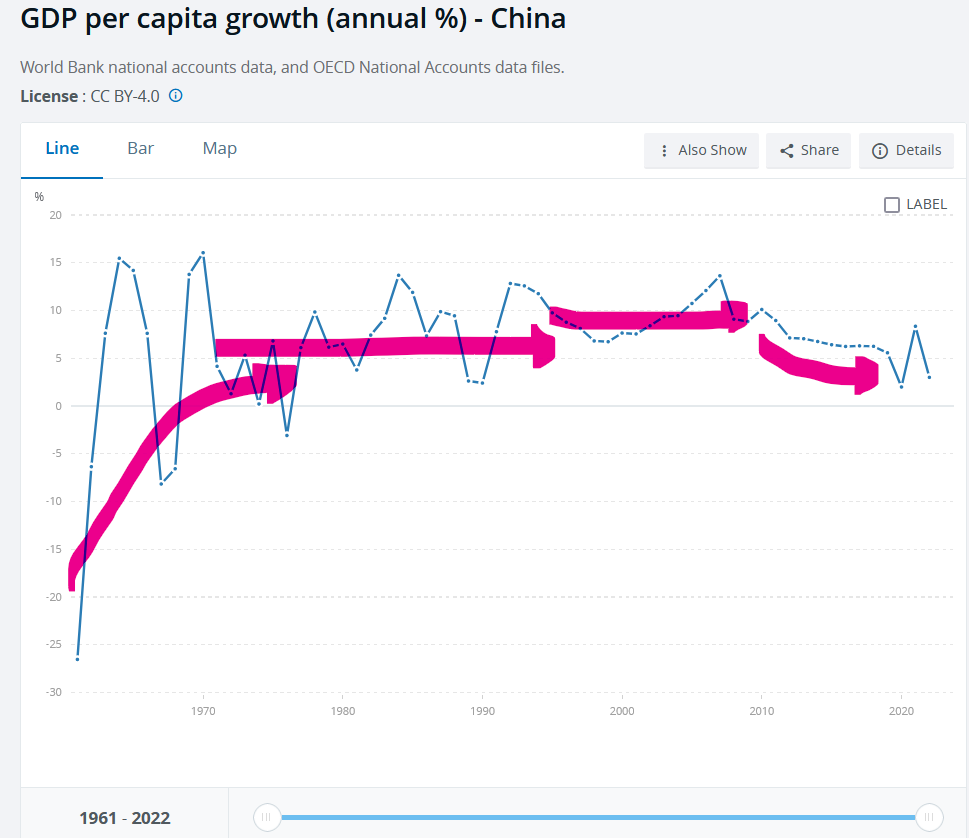

GDP GROWTH PER CAPITA CHINA

Meanwhile, China has suffered only ONE recession in 1976 in that whole time period. In all other years, it has registered a positive growth in GDP per Capita. That is an extraordinary achievement and super extraordinary when compared to what has happened in Argentina, the USA, Europe, the UK and Japan.

China’s consistency of economic growth and stability has been historic. 1.4 Billion people have been lifted out of relative poverty, an extraordinary achievement.

Now, let’s look at Japan more closely ……..

JAPAN’S MASSIVE RAIL SYSTEM AND POWER USAGE

RIDING JAPAN’S FASTEST BULLET TRAIN

As readers know, BOOM has just returned from Japan. Last week’s report on Japan examined economic life in a de-growth economy and how that may play out over the coming decades as the population slowly but surely declines by up to 30% (or more) by 2070. This week, BOOM will look at Japan’s amazing train system including the wonders of Shinkansen and China’s equally amazing High Speed train network.

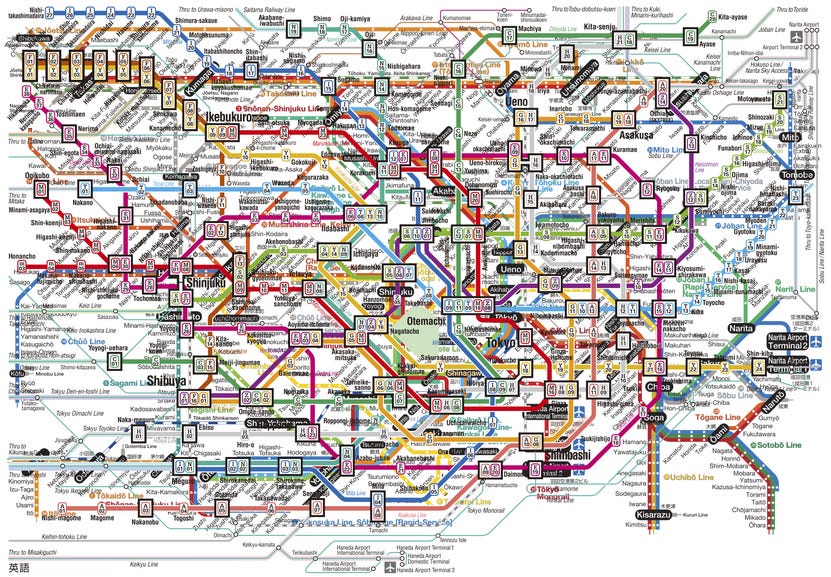

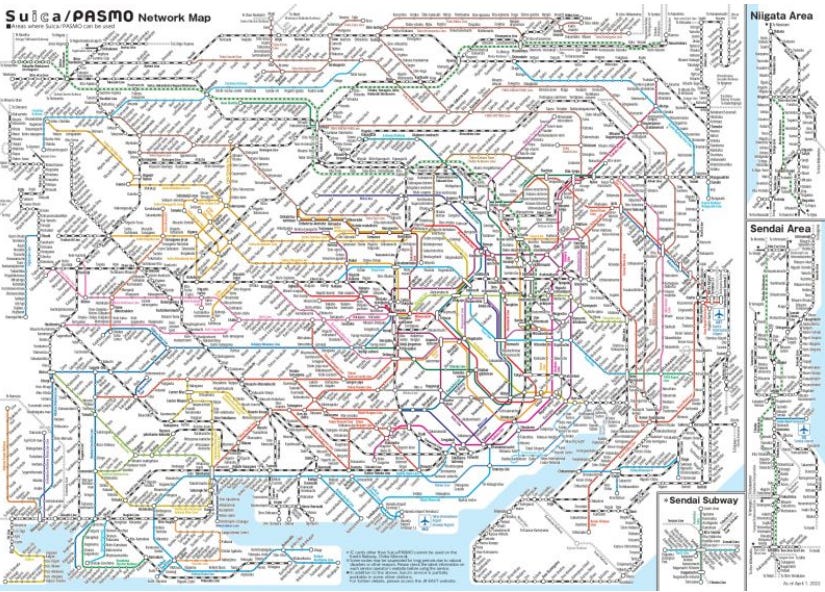

Just to get you started, here is a Subway Map for Tokyo.

TOKYO SUBWAY MAP

Looks impressive? However, that is actually a limited map. This is a more comprehensive one which includes linkages to connecting rail systems – you get the drift? Remember, over 37 Million people live in Greater Tokyo.

Here are two Shinkansen High Speed trains, provided for those who have never seen one.

Rail transport services in Japan are provided by more than 100 private companies, including

- Six Japan Railways Group (JR) regional companies (state owned until 1987) which provide passenger services to most parts of Hokkaido, Honshu, Shikoku, and Kyushu;

- The nationwide JR freight company; and

- 16 major regional companies which provide railway services as part of their corporate operations. There are also dozens of smaller local private railways.

The entire Japanese rail network carries Billions of passengers per year. In the fiscal year 2022, the number of passengers carried via railway transportation in Japan amounted to approximately 21.05 Billion. The system is incredibly complex yet super efficient, an economic marvel in itself.

ENERGY USAGE IN JAPAN

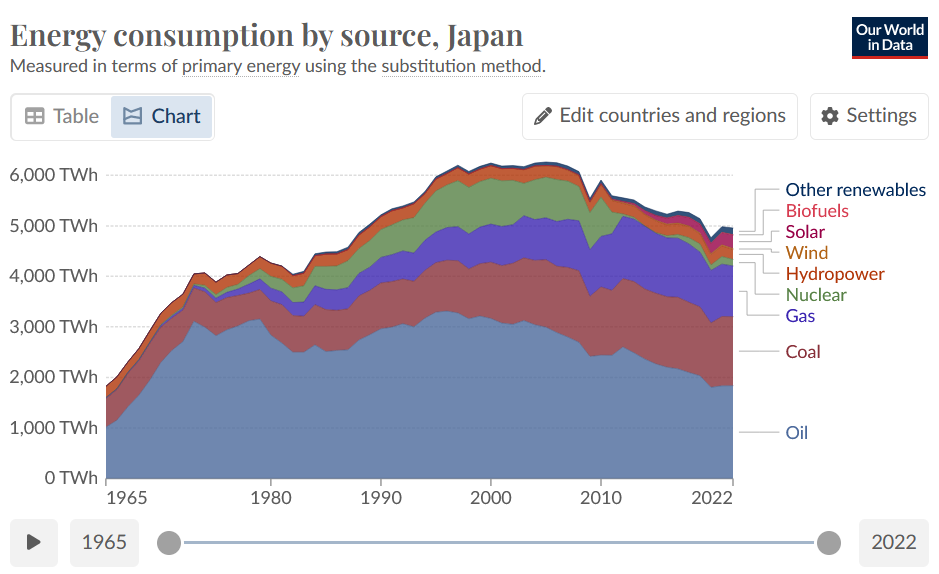

This requires a lot of energy and Japan is a nation with almost no fossil fuels. It imports 97% of its oil and is the largest importer of LNG gas in the world. Where does all the energy come from?

The following graph shows the pattern of absolute energy source and consumption in Japan since 1965, measured in TerraWatt Hours. You will see that total energy consumption peaked at around the same time as Japan’s population peaked at 128 Million in 2009. So Japan’s energy problems are actually being solved by falling population numbers and persistent economic contraction. That is an intriguing thought. (!)

Japan’s total energy usage has returned to levels that occurred in the late 1980’s – almost 30 years ago. It has declined by almost 17 % since the peak in 2009.

Over 85 % of the energy consumed is from Coal, Gas and Oil. Almost 10 % is provided from Solar and Hydro. Other “renewables” such as wind and biofuels amount to 2.6 % and Nuclear is another 2.6 %.

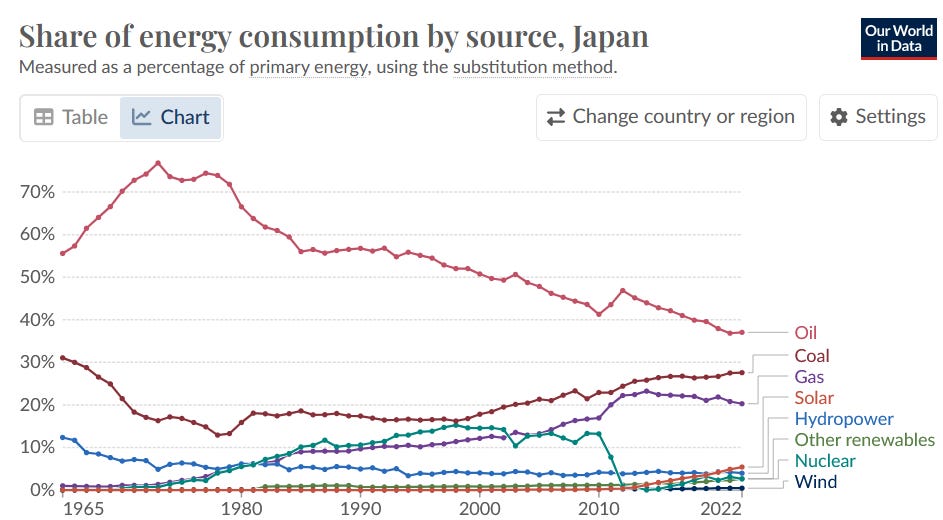

JAPAN ENERGY CONSUMPTION

This chart shows the relative percentages of contribution over time. You can see clearly that oil has been steadily falling as a fuel while coal has been steadily rising.

JAPAN SHARE OF ENERGY CONSUMPTION BY SOURCE

RIDE JAPAN’S FASTEST BULLET TRAIN – THE HAYABUSA – TOKYO TO HOKKAIDO

Here is a ride on the fastest bullet train in Japan – from Tokyo to the Northern island of Hokkaido at 350 Kms per hour (over 200 Miles per Hour). It includes the world’s longest undersea tunnel. Watch at Double Speed for the first 10 minutes or so only. You can watch the rest later, after reading BOOM.

COMPARING ECONOMIES

At this juncture, it is interesting to compare National Nominal GDP numbers between Japan and other major economies in US Dollars per person/capita. BOOM is using IMF estimates here. Other estimates from the World Bank and the United Nations differ substantially.

Japan’s Nominal GDP per person measured in US Dollars is US $ 33,000.

Australia’s Nominal GDP per person measured in US Dollars is US $ 70,000.

USA’s Nominal GDP per person measured in US Dollars is US $ 87,000.

UK’s Nominal GDP per person measured in US Dollars is US $ 50,300.

China’s Nominal GDP per person measured in US Dollars is US $ 13,000.

That comparison begs a look at China’s railway system (!).

The reality of China is being kept secret from the West by its mainstream media.

CHINA TOWERS – CHENGDU

Chengdu is the capital city of the Chinese province of Sichuan. With a population of 20,937,757 at the 2020 Census, it is the fourth most populous city in China.

CHONGQING – Population 30 Million — Capital of Chongqing Province —

SANYA ON HAINAN ISLAND — CHINA’S RESORT ISLAND

CHINA’s RAIL NETWORK AND HIGH SPEED RAILWAYS

MORE than 2.61 Billion passengers travelled by rail in China in 2021, up 18.5% compared with 2020, with 2.53 billion of these passengers carried by China National Railway (CR), according to figures released by the National Railway Administration.

About 10 months ago, on 6th August 2023, BOOM wrote the following about China —

“ …. the entire US high speed rail “network” is half the length of just one bridge in China. The US (high speed rail) “network” is 80 kms long versus 42,000 kms in China.”

CHINA NEW RAIL INFRASTRUCTURE MASSIVE COMPARED TO THE USA

The high-speed rail (HSR) network in the People’s Republic of China (PRC) is the world’s longest and most extensively used with a total length of 42,000 kilometres (26,000 miles). Most trains travel above 300 – 330 Kms per Hour (200 Miles per Hour). China’s HSR accounts for two-thirds of the world’s total high-speed railway networks. The Shanghai Maglev is the world’s first high-speed commercial magnetic levitation line. The Maglev trains can reach a top speed of 430 km/h (267 mph).

MAGLEV TRAIN IN CHINA

In comparison, the United States has only one high speed rail service, Amtrak’s Acela. Its length is only 80 kms (50 miles) long. Think about that – the entire US high speed rail “network” is half the length of just one bridge in China. The US “network” is 80 kms long versus 42,000 kms in China.”

CHINA HIGH SPEED TRAINS

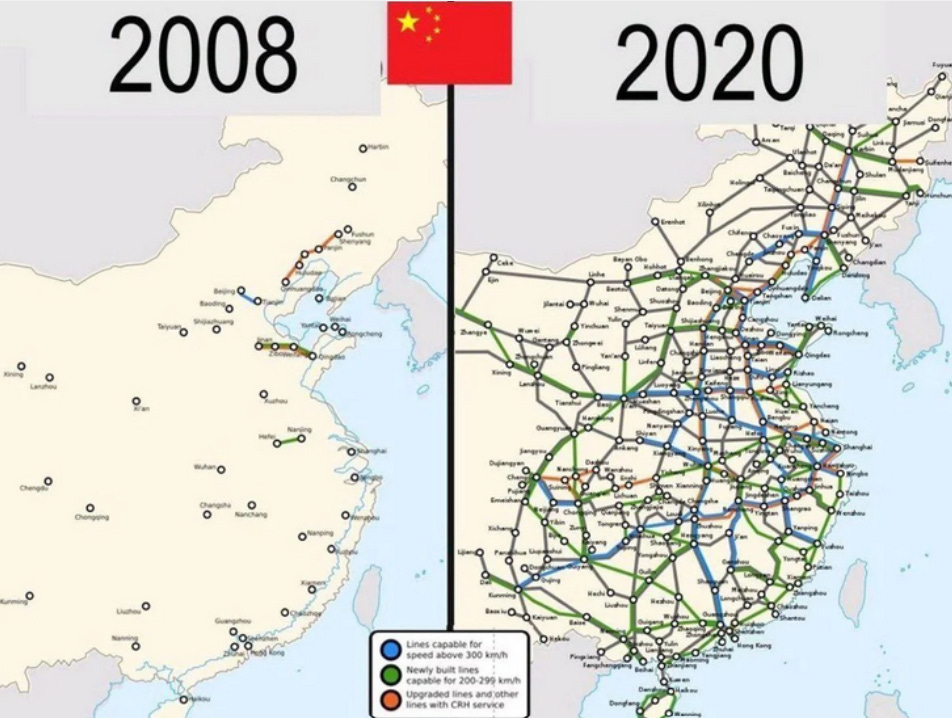

CHINA LONG DISTANCE RAIL NETWORK BUILT IN JUST 12 YEARS — FROM 2008 TO 2020 — CURRENTLY 40,000 KMS — WILL BE 70,000 KMS BY 2035

LIVING IN CHINA

Last week, BOOM discovered a YouTube channel called Living in China presented by a British man who has lived in mainland China for over 10 years, Jason Lightfoot. Jason is an avid enthusiast for living in China. He is married to a Chinese girl and they have a cute, happy son called Lincoln.

Clearly, some of Jason’s reporting displays strong bias and borders on propaganda. Worryingly, he seems to blithely agree with mass citizen surveillance and tracking. He seems to be happy with Digital ID identification linked to payment systems. He does not cover the Chinese justice system or its totalitarian political system. He seems unperturbed by the use of face masks (which are disturbingly common in the videos). And he loves to point out America’s failings.

By the way, face masks provide almost no protection against respiratory viral infections. If you are not sure, you can check out the Cochrane Review on the matterpublished in January 2023. Cochrane Reviews are regarded as the “Gold Standard” in evidence-based Medicine – Physical interventions to interrupt or reduce the spread of respiratory viruses

The Conclusion of the Review: “The pooled results of RCTs did not show a clear reduction in respiratory viral infection with the use of medical/surgical masks.”

Jason should tell the Chinese government that.

And the Chinese Government should listen.

But perhaps the emphasis on using masks is a control mechanism (?), designed by a Totalitarian Government to generate compliance? BOOM suspects that is the case.

Reference: https://www.cochranelibrary.com/cdsr/doi/10.1002/14651858.CD006207.pub6/full

Back to Living in China —

Despite these failings, Jason’s videos are mostly factual and the facts cannot be argued with. He shows the dramatic, gleaming, new subway stations in many Chinese cities. He shows the public parks, the sparkling shopping malls, the safety of city streets, the people travelling and walking in the streets and malls, the lack of crime. The infrastructure on show is simply amazing.

Here is one of his videos – it is only 8 minutes long but it is rather staggering. If his presentation style annoys you, just switch the sound off and watch the video evidence he presents. And, by the way, all of China’s infrastructure and high speed rail network does not run on windmills or solar panels. That is obvious. Those forms of alternative energy production clearly cannot drive China’s present economy or its future.

China Railways vs India Railways – This is truly shocking…

And here are more – but watch later (at high speed) after reading BOOM. You will be amazed.

China’s Infrastructure from the FUTURE… in Chengdu City

Americans Won’t Believe What China Built… in the City of Changsa

and

Here is a video from another visitor to China – Fel Thommy — again, you can watch all these videos at double speed to give you a quick overview.

WESTERN DEMOCRACY MUST RESCUE ITSELF

China has built much of this impressive public infrastructure over the last 12 – 16 years while the politicians in Western, advanced economies have been engaged in ideological arguments, endless warfare, fear mongering and super-hyped “pandemic” panic. Our current crop of politicians in the West are almost all short sighted, deluded and uncaring. Sociopathic behaviour is common. Psychopathic behaviour is observable, with no real concern or compassion evident for the common man and woman in the street.

So, why is the West embarking upon its own, self directed, economic destruction? Are the politicians in the West being mind-controlled in some way? Or have our democratic systems generated a predictable outcome with power hungry people inevitably rising to the top?

Is Sortition an experiment that we need to consider?

Sortition (also known as selection by lottery, democratic lottery) is the selection of public officials or jurors using a random representative sample. In the democracy of ancient Athens, sortition was the traditional and primary method for appointing political officials, and its use was regarded as a principal characteristic of democracy.

Yes — the Greeks worked out how to block sociopaths and psychopaths 2,500 years ago. (!)

BOOM’s CHINA ECONOMIC INDICATOR RISING STRONGLY

BOOM’s key indicator for the Chinese economy is now rising strongly and is at levels last seen 18 months ago. It turned decisively in early January.

Chinese stock markets have also continued to rise since making a decisive low in early February. Since then, the Shanghai Composite Index has risen by almost 19 % in just 3 months. If that rate of climb were to continue for 12 months, the index would be up by 80% by the end of the year. That is unlikely to happen but it illustrates the strength of the turn-around.

SHANGHAI STOCK EXCHANGE COMPOSITE INDEX

In the same time frame, the Hong Kong Hang Seng Stock Index has risen by almost 30%. A stunning performance.

HONG KONG STOCK MARKET INDEX

BOOM’S CHINA FORECAST

On 21st January, BOOM wrote “BOOM’s China trade indicator has turned upwards in the last 2 months and is gaining strength. This is a reliable sign of increased Chinese trade which usually precedes a resurgence of the domestic economy.” And ….

“… if the upswing in external trade continues, then we should soon see a rebound in the Chinese economy and a subsequent rebound in stock prices.”

And on Sunday 4th February, BOOM wrote — “the Chinese stock market indices have not yet shown a base formation. However, with huge investment inflows and a recovering trade picture, there is potential here for a significant turnaround soon in stock market valuations.”

BOOM’s forecast was spot-on accurate. And it looks like BOOM readers in China and elsewhere (especially large fund managers) took notice and decided to start buying.

Then, on the 18th February, BOOM wrote —

“China’s government is communist. However, they must now encourage all of their citizens to become buyers of shares in Chinese companies. If they don’t, the Chinese stock markets will be at risk of progressive slow melt down with no end. And if that were to happen, the ownership of corporate China will become locked into fewer and fewer hands, creating an elite class of citizens who (will) own the productive assets of China.” …. “None of that is compatible with communist ideology. Therefore, the best way forward is for the central government of China to encourage its citizens to start buying shares as soon as possible.”

“BOOM is expecting such a direction from the Chinese government soon. It is actually inevitable because the consequences of not doing this are too great to ignore.”

HOW CAN CHINA ACHIEVE SO MUCH SO FAST?

BOOM is not an admirer of totalitarian government. Communism has many faults. However, it is unwise to simply ignore China’s historically successful management of its economy over the last 60 years to the benefit of the vast majority of its citizens. The answer to this question lies with China’s unique system of finance. BOOM will discuss that next week. Stay tuned.

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

BOOM — ALL PREVIOUS SUBSTACK EDITORIALS AVAILABLE AT BOOM SUBSTACK ARCHIVE.

ALL PREVIOUS EDITORIALS AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics at Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years on other platforms which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Thanks for reading BOOM Finance and Economics Substack! Subscribe for free at Substack to receive new posts and support my work.